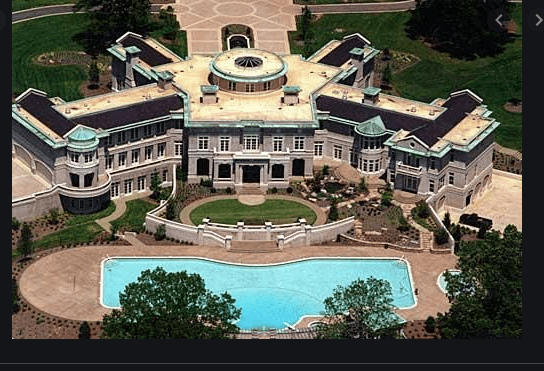

Do you happen to recognize the house featured in this particular blog post? Quickly take a much closer look. Is it starting to come to you now? It’s located in Atlanta.

And it’s an impressive, 54,000 square feet. Say what? That’s correct? And not long ago, it belonged to former, four time heavyweight champion of the world Evander, “Real Deal” Holyfield. Before his inevitable, financial insolvency reared it’s ugly head.

And sadly, like so many other seemingly wealthy or at least rich, superstar athletes or superstar movie or entertainment icons. Once all the smoke cleared.

What looked like on the surface anyway. An extremely financially successful icon. Was nothing more than a house of cards, or mountains of debt. Waiting to take it’s inevitable toll on another once great, exceptionally gifted athlete. Who basically squandered his extremely hard earned fortune.

And Evander’s case, was not to be the exception. As you’re about to discover.

Unfortunately Financial Insolvency Often On The Surface Initially Looks Like Financial Success!

Case in point. Watch the video featured in this particular post. It’s a seven plus minute clip, from a reality show, hosted and narrated by former major league baseball superstar, “Alex Rodriguez, (aka) “A- Rod.”

The premise of the show, “Back In The Game.” A- Rod uses his considerable, entrepreneurial skills, resources, real world knowledge and other assets. To help former extremely high earning athletes, ex – athletes, iconic entertainers and movie stars etc.

Try and get back on their feet financially. And obviously not like their past glory days. But enough, so they can not only keep a decent roof above their head.

But start building, some type of financial security and paying off any lingering debt. And speaking of debt. it seems like Evander certainly had and has his fair share of that. Because rumor has it. Now that he’s officially retired from the ring. And can no longer ever realistically expect, to earn another dollar from prize fighting.

His Continuous Money Problems Came In continuous Waves In All Shapes And Sizes!

He’s still legally on the hook for child support, for his eleven kids. And then there’s those string of really bad investments he constantly made. From everything to failed soul food restaurants.

Lending his name for a never got off the ground barbecue sauce. Lending his name and brand to of all things a fire extinguisher product, which ultimately failed

An outrageously expensive hip hop record label, which sucked up a ton of his money. Yet ultimately failed to produce any successful artists. (Who would have thought.)Before it officially bit the dust. And took millions of his dollars with it.

And you know his three, extremely high profile divorces, couldn’t have been cheap, right? And at one point he had at least $500K in overdue child support payments, not counting any accumulating interest. Ouch.

Hey, you’ve seen and heard it many times, correct?Superstar athlete or superstar entertainer, goes hog wild while they can, and ultimately end up broke. Right?

So not to try and take up for him having to file for some sort of bankruptcy protection. Consider the flip side of some of his financial escapades. Huh?

While All Of His Money Was Steadily Going out! (At Least It Did Do Some Good As Well!)

For just a mount, stop and really consider, and appreciate how many different times at least part of Evander-s $200,000,000 plus million dollars in lifetime career earnings. Went to help other business owners or service providers, and their full and part time workers pay their bills.

Case in point. Consider “how” much the land alone initially cost, for Evander to ultimately build his twenty plus million dollar mansion. So a broker or brokers, earned a nice fee did they not? Yep.

Then the county where the home was actually located. The tax access-or, was able to generate a nice annual income, before the property initially went into foreclosure, right? But hey, now the new owner(s) pay the annual property taxes.

And let’s not discount, nor neglect the local contractors, whose crews actually built the property. This entire project probably took start to finish, anywhere from 12- 18 months. Possibly longer.

When you consider the mansion also had a pro style bowling alley and Olympic size pool added to the mix. Fancy stairways. The electrician and their crews had to properly wire the entire house, right? No doubt.

[cpm-player skin=”classic-skin” width=”100%” playlist=”true” type=”audio”] [cpm-item file=”https://www.youcanmarketonlinenow.com/wp-content/uploads/2014/09/This-is-why-you-gotta-start-building-passive-income.mp3″]This is why you gotta start building passive income[/cpm-item] [/cpm-player]

And the plumber and crew had to make sure the plumbing was hooked up correctly. The point being, look all of those individuals and service providers, who were steadily employed for months. (Plus the occasional repairs.)

And you know he didn’t have any cheap furniture right? It was strictly state of the art. So who knows how much he and his wives, ultimately spent, to furnish the entire place.Before they were legally forced to leave.

(He remarries, and the new wife comes in and demands he /they get rid of the old furniture and immediately replace every room with all new furnishings.) This definitely couldn’t have been cheap. Right?

And for sure both he and his former wives were not getting around town by old fashioned horse and buggy, right? No way. So there was adequate car Insurance and maintenance while he could foot the bill, correct? Absolutely.

Don’t Confuse The Appearance Of Wealthy With Actually Being Wealthy!

But of course there was the inevitable upkeep. And rumor has it. By the time Evander initially step foot into his twenty million dollar dream home. His career and finances were both on the rapid down slide.

Which meant, while he may have still been grossing, anywhere from $20-$30K per month, for his appearance fees.

Before deducting uncle sam-s taxes and his overdue child support payments. The total financial upkeep, for his sprawling dream home, was costing him a cool million dollars per year.

Between the full time gardening crews, lightening, heating, air conditioning, annual property taxes.(Which probably kept gradually going up, if not year after year. At least every couple of years.)

Full time maintenance crew. Electrical costs. Olympic pool maintenance, round the clock security system and team.

And whatever creative and probably totally unnecessary costs you and I can possibly think of. The guy was financially insolvent.

He just hadn’t truly come to grips with it yet. Don’t you agree? His former mansion and collection of fancy vehicles. On the surface, are the appearance of wealth or financial success.

But as you and I can clearly see. Underneath the facade was financial insolvency, just waiting to be officially acknowledged. Don’t you agree?

Sadly Far Too Many Superstar Athletes And Superstar Entertainers Would Rather Temporarily Appear Rich! (Than Actually Invest The Continuous Effort Of Learning How To Become And Remain Wealthy!)

P.S.Now as is customary during this part of our show.Please share your extremely valuable comments (in the comments section below)

that you can apply to your business,product or service in the next 30 days or less!

As always, if you got any value out of this post, please share this on your favorite social media sites or tweet this.Thanks!

And if you’re currently registered on Linkedin or twitter,and you’re serious about about doing some type of power networking.Let’s get connected asap!

Extremely important note:And if by chance, you happen to know any of the lesser known podcasters,who also target,small business owners,service providers or aspiring startups entrepreneurs etc.

And they’re pro-actively looking for potential guest speakers.Please don’t hesitate to-either- pass their name and contact information directly

to me or vice versa!Thanks!

And be sure you grab your explosive free 22 step small business marketing idea kit series,because it will help you increase your gross profits by

as much as 25% in the next 90 days or less.

And help you master your effective communication in marketing skills.(No matter what your particular niche market is.)

It’s a $97 dollar value and it’s free!